This article is more than 1 year old

Symantec’s dismal results show need for Veritas sale

Security firm needs to Caesar the opportunity to grow the business

Symantec’s latest results, published on the day of the Veritas sell-off announcement, show a 14 per cent revenue decline and 49 per cent profit fall on the annual compare.

Revenues of $1.5bn produced profits of $117m, compared with $1.74bn and $236m respectively a year ago. On the sequential compare, the previous quarter’s numbers were $1.52bn in revenues and $176m in profits. It’s all downward-bound.

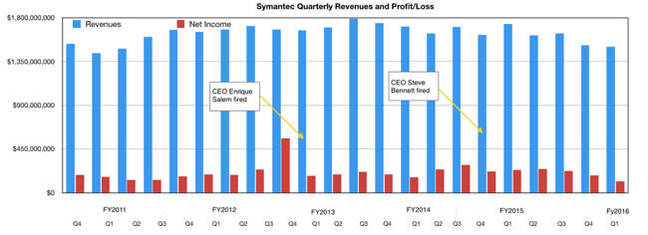

CEO Michael Brown jumped into the hot seat in March 2014 and both revenues and profits have trended downwards since then, as the chart below shows.

Selling Veritas is the get-out-of-jail card, enabling Brown and his execs to concentrate on Symantec’s security business and get it growing.

A canned Brown quote said: “We made encouraging progress in several product segments, achieving growth in our enterprise security business for the first quarter in two years. However, our revenue was flat in Q1, adjusting for currency and an extra week in the June 2014 quarter. Reaching a definitive agreement to sell Veritas marks an important inflection point for Symantec."

"With a strong product pipeline of more than a dozen enterprise security products on track to be released this year, Symantec is now focussed on extending its lead as the world’s largest cybersecurity company," he added.

In Brown’s prepared remarks for the earnings call, he said the Veritas sales cash gave increased financial flexibility to “allow Symantec to pursue organic and inorganic opportunities to accelerate our Unified Security strategy.”

This consists of three elements:

- Unified security analytics platform, which leverages Big Data analytics of Symantec’s telemetry to enhance visibility of real-time global threats, and power analytics applications

- Using the analytics platform to provide best-in-class consumer and enterprise security software

- Cybersecurity Services providing a suite of services from Monitoring to Incident Response to Threat Intelligence supported by over 500 cybersecurity experts and nine global security response centres

Security analytics is the key here. Brown is saying that Symantec is going to be on the lookout for buying other security companies and their technology.

First quarter revenues were screwed up by separating the Symantec and Veritas sales forces, working on splitting the business infrastructure between the two halves and then, thirdly, selling Veritas to the Carlyle Group with all the associated due diligence work.

Veritas revenues (Information Management) grew by over three per cent, driven by continued strength in NetBackup and appliances.

CFO Thomas Seifert said: “Information Management revenue increased three per cent to $587m. NetBackup software and appliances grew 10 per cent and 19 per cent, respectively. This strength was offset by weakness in our Backup Exec and Information Availability offerings.”

Basically, Veritas is waiting for new products such as NetBackup v7.7, InfoScale, the Veritas Resiliency Platform and the Information Map.

Of course, its also waiting for the strategic direction to be confirmed by its incoming CEO, Bill Coleman. His first quarter nominally in charge starts now, although the sale won’t formally close until 1 January.

Veritas could be coasting until then, relying on the new products in its pipeline to provide any growth. Countering that is the re-organised Veritas sales force, which should become more effective.

Brown said in the earnings call: “Folks now are managing their own pipeline, the management structure and territories, quotas, all in place now for the second quarter.”

Analyst Daniel Ives asked a loaded question on the call: “How do we have confidence, or investors have confidence that in terms of M&A, that now you guys make the right deals, the right spaces, just given the history as we've seen over the last decade?”

Brown said things are different, as Symantec has its unified security strategy to guide acquisition activity, and cited the Vontu buy as a great acquisition “that brought us DLP that we've created into a flagship product line for Symantec”.

What Brown has to do now, is to turn the phrase "veni, vidi, non vici" into "veni, vidi, vici" and put the doubters to rest. ®