This article is more than 1 year old

Mutant upstart Nimble embiggens revenues – and losses, too

Red in the face, red on the financials

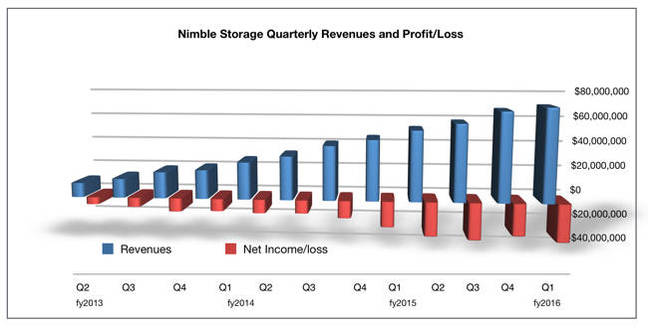

Hybrid array storage start-up minnow Nimble Storage saw revenues grow strongly in its latest quarter, though not enough to trouble mainstream storage vendors.

Revenues in its first fiscal 2016 quarter, ended April 30, were 53 per cent higher than a year ago at $71.3m, with a net loss of $29m: it was $19.6m a year ago. Sequentially, the revenue growth rate was slower, being just 9.4 per cent higher than the preceding quarter's $71.3m.

Foreign exchange issues adversely affected revenues.

The outlook for next quarter is for revenues of $77-79m, 45 per cent up on the year-ago Q2 at the mid-point. The net loss for Q2 is expected to be between 11 cents to 12 cents per share – on that measure it was 10 cents for Q1.

The revenues and earnings were better than Wall Street analyst expectations. During the quarter, Nimble recruited Denis Murphy as its VP for worldwide sales. He replaced the departed Eric Mann, meaning CEO Suresh Vasudevan can step back from running the sales force as well as the company.

The chart shows Nimble's quarterly sequential growth slowing slightly and the losses deeepening, although CFO Anup Singh said: "We remain on track to achieve non-GAAP operating income break-even by the end of the current fiscal year." And, hopefully, a GAAP profit in fiscal 2017.

At some stage cost growth has to stop or slow significantly, so that revenue growth can generate a profit.

In the quarter, Nimble's customer count rose to 5,521, with 542 added in the quarter, and the number of deals worth more than $100,000 was up 142 per cent on the year. Fibre Channel-connected array bookings rose to 14 per cent in the quarter, up from 10 er cent in the prior quarter – steady growth, but not spectacular.

Repeat business accounted for 51 per cent of bookings in the quarter, showing that Nimble's customers are loyal.

Stifel Nicolaus MD Aaron Rakers put Nimble's results in a storage market size context: "Based on incumbent storage results (EMC, NetApp, IBM, HP, and Hitachi), we estimate Nimble’s relative revenue share is still only 1 per cent." He also sees an "implied deceleration in yr/yr iSCSI revenue growth," for Nimble, with a sales channel focus more on Fibre Channel sales than iSCSI ones.

The company will need to add more sales heads to counteract this. It added 66 new employees in the quarter and this headcount growth – and consequent cost growth – is expected to continue for a while.

Nimble's rise should continue as it exhibits what its CEO calls controlled momentum, but it is not yet a giant-killer. ®