This article is more than 1 year old

IDC: Who's HOT and who's NOT (in object storage) in 2014

EMC's presence shrinks

IDC’s latest object-storage "marketscape" shows 18 active players and significant changes in EMC’s and HDS’ status.

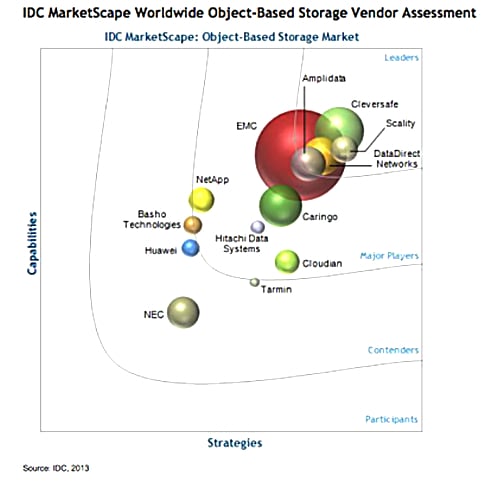

The chart, IDC’s sort-of answer to Gartner’s Magic Quadrant, positions rivals in a 2-dimensional box, using capabilities and strategies as axes. There are four bands inside the square, one for the "participants", one for the "contenders", one for the "major players", and one for the "leaders".

Be successful, and IDC will position you high up the square and over on the right, towards the leaders. The size of a supplier’s dot in the 'scape indicates its relative market share.

Here is the 2013 version, with 13 players and Cleversafe in pole position followed by Scality, EMC with the largest market share, DDN and Amplidata. The other suppliers are outside the leaders' area:

2013 IDC Object Storage Marketscape

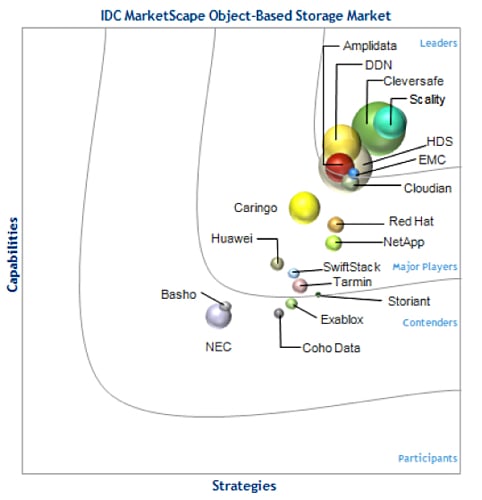

And this is the 2014 IDC Object Storage Marketscape with five additional market entrants; Coho Data, Exablox, Storiant, SwiftStack and Red Hat:

2014 IDC Object Storage Marketscape

And here's how we reckon the suppliers rank in 2014 (with 2013 ranking in parentheses where applicable) based on their position in the Marketscape box:

- 1st: Scality (was 2nd)

- 2nd: Cleversafe with largest market share (was 1st)

- 3rd: DDN (was 3rd)

- 4th: HDS (was 7th, a big promotion)

- 5th: Amplidata (was joint 5th)

- 6th: EMC (was joint 5th, a much diminished market share)

- 7th: Cloudian (was =7th with NetApp)

- 8th: Caringo (was 6th)

- 9th: Red Hat

- 10th: NetApp

- 11th: Huawei (promoted to major player from contender)

- 12th: SwiftStack

- 13th: Tarmin (promoted to major player, was 12th)

- 14th: Storiant

- 15th: Exablox

- 16th: Coho Data

- 17th: Basho (big fall from 10th)

- 18th: NEC (was 13th and last before)

IDC thinks the object storage market will increase by 27 per cent (CAGR) over the next four years.

Cleversafe says it is “the industry-leading object-based storage provider [and] was named a leader in the IDC MarketScape: Worldwide Object-Based Storage 2014 Vendor Assessment (December 2014.)” Note the use of “a leader," and not "the leader."

IDC research director for storage systems and software, and author of the report, Ashish Nadkarni, was quoted by Cleversafe as saying: “Cleversafe’s company strategy to offer its platform both as software designed to run on standard servers as well as its own storage appliances is a good match for the market’s direction.”

HDS' bump up the rankings contrasts starkly with the fading presence of EMC, where ViPR and Isilon object storage has not, apparently, built on the surge established by Atmos. EMC is quite near the point where it would fall out of the leader area and become a major player, along with the likes of Caringo, Red Hat, NetASpp and others.

It could even be overtaken by Cloudian. Perhaps in this market, first mover advantages aren't there to be had unless you develop your product fast. ®