This article is more than 1 year old

Tide turns for channel: Now vendors are fighting for YOUR loyalty

How to use channel consolidation to your advantage

Over a year ago, Forrester predicted that the number of channel companies was set to decline dramatically by up to 15 per cent for various reasons.

The prediction, at first belittled by our reader clients who still assume that they are selling into an adoption market which continues to grow, has since been reinforced in many meetings with channel executives: they now universally opine that there will be fewer channel companies worldwide in five years' time.

Some of that decline is market consolidation (mergers & acquisitions), and those involved channel companies will indeed be larger and able to accommodate more tech vendor demand.

But a significant number of channel companies are simply going to be forced to shutter their doors, because cloud technologies enable channel companies to serve more customers (eg, in the form of application hosting or managed services).

Channel companies that achieve these types of scale efficiencies will force laggards out of the market. The result: a diminishing supply of channel companies.

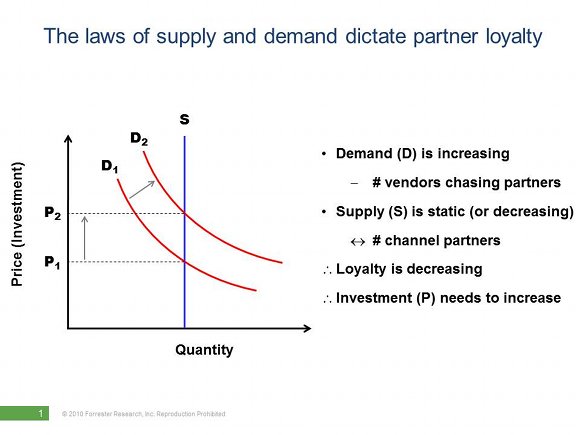

One of the basic laws of supply and demand dictates that as demand increases and supply remains static, price will increase.

Given the aforementioned decrease in channel supply and the increasing number of tech vendors seeking new partners or bigger partner wallet share, this law applies very well to the situation in the partner & channel ecosystem today (see graph above). But a variable not usually included in the basic economics law, in our context, is that of partner loyalty (L) – because before tech vendors can adjust price (investment) levels up to account for their own increased demand, partner loyalty will decrease.

So, with more tech vendors chasing a static (or decreasing) number of channel companies, for channel companies, it’s a “buyers’ market” – where you, the channel partner, are the buyer. Vendors are beginning to understand this and are investing accordingly.

So, when you evaluate, compare or select a vendor channel program to join, we recommend these 10 criteria to be considered. How well does the vendor measure for each of these?:

- Brand

- Breadth of portfolio

- Multiple revenue streams

- Training and certification programmes

- Provision of market knowledge/insight

- Accessibility/support

- “Franchise” protection

- Partner locator website

- Partner community

- “Embedded” business processes and systems

These are the things we think are important. Do you agree or disagree with this observation? And, more importantly, have you analyzed your current vendor relationships based on these criteria? Please comment in the forums below. ®