This article is more than 1 year old

AMD smacks Xeon 5600s with Opteron 6200s

Xeon E5 counterattack imminent

Analysis Advanced Micro Devices is currently winning the core count battle in the x86 server-chip war with the just-announced and now shipping "Interlagos" Opteron 6200s, which cram 16 cores into a big fat G34 socket. That's the same G34 socket that the prior generation Opteron 6100s used, so adopting the new chip is a snap for those server makers who did Opteron 6100 boxes. Ditto for the forthcoming Opteron 4200s, which plug into the existing C32 sockets.

AMD is the only remaining maker of chipsets for the Opteron line after the exit of other players, including Broadcom, Nvidia, and the formerly independent ATI Technologies, which was acquired by AMD more than five years ago.

There were some others, including 3Leaf Systems, LiquidIQ, and Fabric7, all of whom have gone the way of all flesh after trying to peddle sophisticated and interesting Opteron-based platforms, not just chipsets. Newisys was also cooking up a high-end chipset, but never did bring it to market.

The fact that AMD is the sole maker of chipsets for Opterons is not necessarily a big deal. It's not like Intel has a lot of competitors for chipsets for its Xeon and Itanium server platforms, either – although it has a few.

The Opteron 4000 series chips are aimed at servers with one or two sockets, where higher clock speed, low price, and low power consumption are the key factors driving the server purchase.

The Opteron 6000s are for machines with two or four sockets where core count, memory bandwidth, main memory capacity, and I/O capacity are more important, and where and companies don't mind paying the price for that scalability.

The Opteron 4000s overlap with the Xeon E3 (single-socket) and Xeon 5600 (dual-socket) processors in the current Intel lineup, while the Opteron 6000s overlap with the Xeon 5600 and the Xeon E7 (two, four, or eight sockets) processors.

There is not an easy one-to-one mapping of the chips and their related server platforms. And it will get a bit more confusing when Intel finally gets the "Sandy Bridge-EP" Xeon E5 processors to market early next year, which will come in versions for one, two, or four sockets.

The fact that the Xeon E5s are not shipping formally until early next year is, in theory, good for AMD, which can pitch the new Opteron processors against the Xeon E3 and 5600 processors. But the reality of the situation is that both Intel and AMD have been shipping their E5 and Opteron 6200 processors for several months, and the cat has been mostly out of the bag about both sets of machines in terms of general capabilities – which means that the Opteron 6200s are not just competing today against the current Xeon 5600s in the belly of the x86 server market, but also against the Xeon E5s that have been shipping for months to cloud and HPC customers.

This may mean that some server buyers will hesitate until next year so that they can see the pricing and performance of the Xeon E5s, even if that means leaving some 2011 server budget unspent. Others wanted the Opteron 6200s already, and it won't matter what Intel does with the Xeon E5s because – for their workloads – sixteen real cores beats eight HyperThreaded cores.

The Opteron 6200 sales pitch

As is the case with all processor lineups, the top-bin parts, which have the highest performance and often the lowest yields, are not the most frequently purchased models. Also, the pricing that Intel and AMD have for their chips more or less scales inversely with yield and much faster than clock speed, so they can extract the most money from their chip lines.

John Fruehe, director of product marketing for server and embedded products at AMD, says that the company looked at Mercury Research shipment data for Intel's Xeon 5600 line, and discovered that the E5640 was by far the dominant SKU sold by Intel this year, with the X5650 above it and the E5630 below it also getting a big chunk of the shipments. These three chips accounted for nearly 70 per cent of server-chip shipments, in fact.

So AMD took the Opteron 6200 and aimed it right at the Xeon E5640, which has four cores, eight threads, spins at 2.66GHz, and costs $774 when bought in 1,000-unit trays from Intel.

The chip that AMD wants to line up against the Xeon E5640 is the new Opteron 6276, which is a 16-core part spinning at 2.3GHz that sells for $788 in 1,000-unit quantities.

AMD chose the SPECint_rate2006 processor benchmark test to gauge the oomph of the two chips. A two-socket Opteron 6276 box rates 480 on the test while a two-socket Xeon E5640 came in at 253 – the Opteron machine delivered 89.7 per cent more integer performance for 1.8 per cent more dough.

But perhaps the most interesting comparison is that the top-speed standard part in the old Opteron 6100 series, the 6176, had twelve cores running at 2.3GHz and cost $1,265. The Opteron 6276 delivers 25 percent more cores and costs 37.7 per cent less. That's a factor of 2.1 times improvement in bang for the buck jumping within the same G34 socket – provided your workload can scale across those extra four cores, of course.

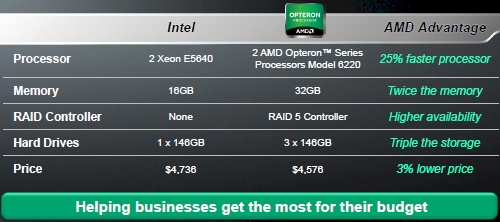

That said, processor price/performance improvement is not the same as the overall system bang for the buck. And so AMD ginned up this comparison to help its server partners better position the new Opteron 6200s against the current Xeon 5600s:

In this comparison, AMD has priced up a two-socket ProLiant DL380 from HP using the Xeon E5640 with 16GB of main memory, and no RAID disk controller. This bare-bones box will cost $4,736. It then priced up a ProLiant DL385 with two Opteron 6220s, which have 3GHz clock speeds and list for $523 each. AMD claims this two-socket Opteron 6220 box offers 25 percent more performance than the machine with two Xeon E5640s. And the extra money you save on the CPUs means you can add another 16GB of memory, a RAID 5 disk controller, three 146GB disks instead of one, and still only pay $4,576.

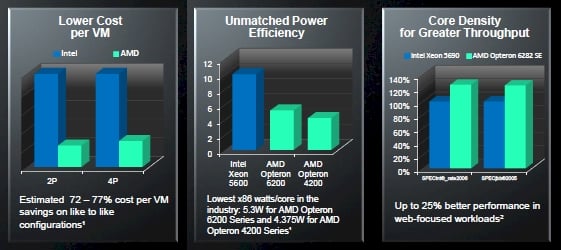

AMD is also touting that the Opteron 6200s can host more VMs at a lower price, that the new Opterons offer the lowest power consumption per core, and have better performance on Web applications, thus:

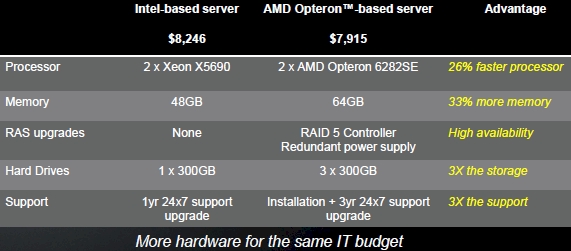

If you want to push the performance envelope, and if money and heat are no issue, here's what AMD suggests is a fair comparison:

The Xeon X5690 is the top-bin 5600 series part from Intel; it has six cores, runs at 3.46GHz, and costs $1,663 each when bought in volume. If you put 48GB into a two-socket ProLiant DL380 and then add one 300GB disk and a year of business-class support, you're in for $8,246. AMD suggests that customer might think about going for two top-end Opteron 6282 SE processors, which have 16 cores running at 2.6GHz and cost only $1,019 each. These processors offer 26 per cent more integer oomph and cost $1,288 less than the Xeons. And that means you can add another 16GB of memory, a RAID 5 controller, and two more 300GB disks in a ProLiant DL385 chassis and keep the price – with a year of 24/7 support – at $7,915.

"This is the secret weapon that is part of the Opteron 6200 announcement," Fruehe tells El Reg. "It is time to stop talking about how your Ferrari matches up against my Porsche and start talking about how my Porsche can absolutely kill your Honda."

Presumably it is AMD that is the Porsche in that comparison. For now.

With Intel shifting to eight cores with the Xeon E5 processors, it will absolutely close the performance gap that AMD just opened up with the Opteron 6200s. So server buyers need to ask themselves a question: will Intel also lower the boom on pricing?

It might, or it could just keep pricing about the same as on the Xeon 5600s on a per-unit performance basis and take some profits, letting AMD gain a few points of market share from what next year will be a price war.

Either way, AMD gives server buyers some leverage in the fourth quarter. ®